2024 ushered in yet another measurable gain for equities, encompassing all major market indexes including our preferred benchmark, the S&P 500. Mega Cap technology stocks again led with the way representing approximately 54% of the index’ return. While still highly concentrated, the S&P 500 did experience ‘broadening’ when compared to 2023’s almost 80% of returns represented by just seven companies, referred to as the Mag 7. How long this trend continues, both from a performance perspective and as a percentage of the cap weighted S&P 500 index as a whole, is a cause for concern for some, leading to consensus that perhaps below-average returns lie ahead.

From a broader perspective both the economy and markets are heading into 2025 from a position of strength. Unemployment remains low, ticking down to 4.1% in December while employers added 256,000 jobs, above analyst estimates. Wages ticked higher and the labor market participation rate remains historically robust. Inflation, while not reaching the Fed’s target rate of 2% last year remains just below 3%, and yet coupled with strength in labor likely puts the extent of future rate cuts in 2025 into question. As we wrote this time last year the Purchasing Manager’s Index (PMI) remains just below expansion territory but ticked higher in December, showing the softest reading of contraction in manufacturing since last March. And while we will not receive a Q4 Gross Domestic Product (GDP) reading until January 29th all signs lead to a tick higher both for the quarter and the year. Above is just a handful of key economic indicators we follow and have outlined in the past.

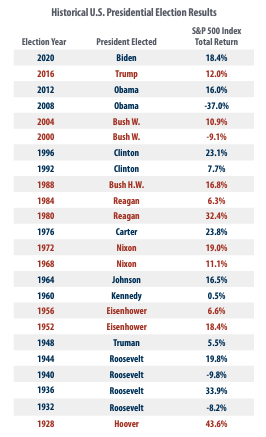

Courtesy: World Bank That said, in steps uncertainty as a new administration is being sworn in as we compose this newsletter on January 20, 2025. Uncertainty began just 20 days following the November 5, 2024, election, a 20-day period of post-election optimism and that led to a roughly 5% rally for the S&P 500. Since that time, forward-thinking markets have fluctuated wildly in an attempt to price in what’s to come. The good news, as we published several times in our Weekly Market updates leading up to the election, is that between 1928-2020 there was an 83% probability (20 of last 24 presidential elections) of positive returns 12 months following an election cycle. With an average trailing 12-month rate of return of 11.58%. Notable economists have projected the new administration’s anchor policies to be inflationary, and yet we cannot overlook an extension of the 2017 Tax Cuts and Jobs Act (TCJA) as favorable to corporations, maintaining or even reducing further the 21% corporate tax rate. As well as a potential additional increase to the standard deduction for individuals and families. Both key components of this administration’s first term. We are not forecasters, and simply put, only time will tell. For more on TCJA click here.

Courtesy: First Trust Portfolios L.P. Overall, 2024, despite a challenging Q4 and December in particular, was profitable for both the Tactical Allocation Portfolio (TAP) and Sector Equities (SEC EQ) models. The rally that began in the fall of 2023 continued, both models still holding several positions purchased in Q4 2023. A handful of isolated risk-management trades presented themselves throughout the year yet were concentrated to very near year-end. A process meant to protect our investors and one that certainly presents itself during periods of above average volatility. For more on your specific results please reach out to your primary advisor.

The fixed-income model remained true to the US Treasury Bill trade over the course of the year, with an exception in Q4. As inflation bottomed out, so did Treasury yields holding just above 4%, forcing us to source alternatives. As was the case pre-inflation, we relied on trusted fund managers to address our client’s fixed-income needs. Only to witness yields spike late in the year forcing a single risk-management event in the fixed-income model as well.

We look forward to what lies ahead and while not as optimistic as the last two years we remain steadfast in the approach given current model holdings and what is viewed as a business-friendly administration. As always, our eye is perpetually focused on risk should markets react unfavorably along the way. Cheers to the new year, we look forward to hearing from you soon.