To summarize Q1 2025 seems a daunting task, we will give it our very best effort. Seemingly every aspect of equity, fixed-income, currency and even crypto markets was affected by President Trump’s igniting a global trade war. After seeing moderate gains in equities to begin the year, domestic markets measured by the S&P 500 index peaked on February 19th. Whether weekly, daily or hourly tariff on/tariff off moved markets both here and abroad. Culminating the week of April 8th which saw the biggest swings in the CBOE Volatility Index since the beginning of the Covid-19 pandemic in 2020, and prior to that the beginning of the financial crises in 2008.

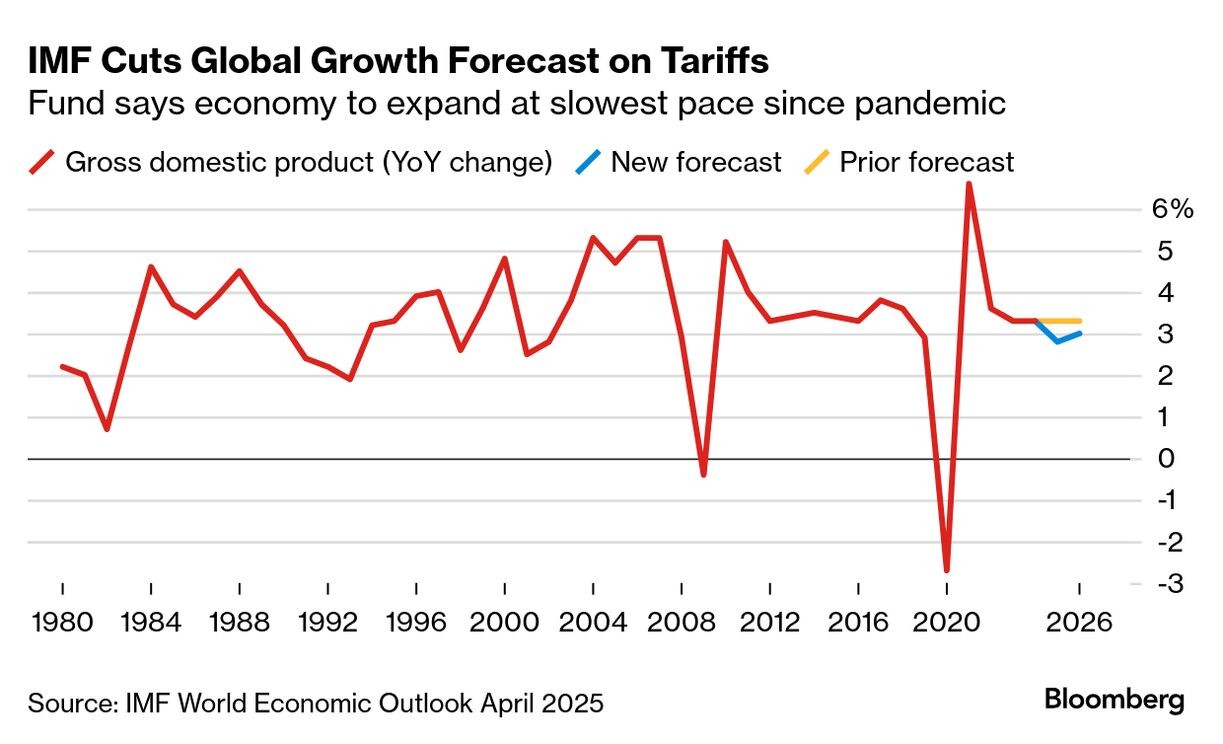

More recently the impact has been a historic rotation out of American, dollar-based assets including US Treasuries, for the first time since the post-World War II era’s General Agreement on Tariffs and Trade (GATT) of 1947. The predecessor to the World Trade Organization (WTO) decades later. Leading the International Monetary Fund (IMF) to cut economic growth forecasts to 2.8% globally, a revision to its 3.3% rate in January according to Bloomberg. Supporting caution from Wall Street banks, J.P. Morgan specifically, now predicting a 60% chance of recession beginning in 2025.

Courtesy: International Monetary Fund / Bloomberg A silver lining came on April 9th when President Trump announced a 90-day pause on ‘reciprocal’ tariffs on foreign goods with the exception of the Chinese. Allowing markets to stabilize somewhat, at least temporarily, giving the White House time to negotiate trade policy with our partners. Another is the potential extension of the 2017 Tax Cuts & Jobs act before certain aspects expire on December 31, 2025. Legislation put in place during President Trump’s first term, that while on the campaign trail, certain components remained popular with both parties.

Needless to say all of the above created chaos and uncertainty. With little clarity or broader economic guidance, goals or what lies ahead. It is worth noting that following the bull market that accelerated in late 2023 market conditions were overbought and ripe for a correction of some type regardless of the outcome of the 2024 Presidential election.

Courtesy: Photo by David Dibert: https://www.pexels.com What does all of this mean for our investors? On the equity side our models’ risk-management measures kicked-in shortly after the February 19th high and accelerated into the middle of March and early April. Depending on the model we find ourselves today with allocations to cash and cash equivalents of between roughly 15-40%. A measurable buffer against potential future gaps down. Overall, we have roughly halved the losses of the S&P 500 Index year-to-date.

For our more moderate investors US Treasuries coupled with fixed-income fund managers we used prior to the spike in inflation and interest rates in 2022 have further buffered risk. Leaving those accounts and households more moderately lower for the year. In the couple of percent range.

If you have worked with us longer-term, together we have managed through bear market cycles with an average duration of roughly 9 months. And recessions with an average duration of roughly 17 months. We feel confident we will get through whatever lies ahead, together, again.

We pride ourselves on risk-management during periods of volatility and participate in growth during periods of relative stability. We have fielded many of your calls over the course of Q1 and encourage you to keep them coming. Rest assured we follow the bottom line each and every day and have your best interests in mind. Thank you for the continued confidence, your future is bright.