Risks including but not limited to the political climate in Washington D.C., recession, stagflation, inflation and tariffs remain and yet equity markets bottomed early in Q2 2025 and have since risen, setting new all-time highs along the way to recovery measured by the S&P 500 index.

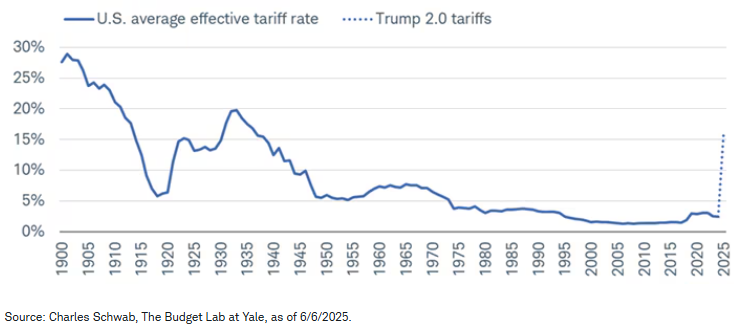

Without a doubt the Trump administration’s rollout of sweeping new tariff policy set the stage. And while negotiations with our trading partners are ongoing, few deals have been made. Most notably with the U.K, China and Vietnam, leaving the average import tariff at ~15%, the highest since the Great Depression in the 1930s. The potential inflationary nature of tariffs is concerning and yet investors have seemingly become desensitized to trade news. Equally as concerning is the rest of the world cutting trade deals of their own excluding the U.S. All of that said we expect the Federal Reserve to cut rates in the second half of the year after an extended period of inactivity while Fed Chair Powell continues to evaluate policy effect on the economy and inflation.

What then drove markets higher? The short answer is consumer sentiment and earnings growth. Coupled with good readings both in terms of labor and manufacturing. The strongest expansion in manufacturing in over three years according to the S&P Global US Manufacturing PMI index. And while showing signs of softening unemployment remains low at 4.1%. According to Charles Schwab

“… we believe the labor market is a key factor in the economic outlook. The present environment can be characterized as one in which companies have cut back on hiring plans but aren’t yet laying off to any significant degree.” And “With two-thirds of U.S. GDP tied to consumer spending, consumer confidence remains key to the outlook—and the strength of the labor market is one of the most important supports for consumer confidence and consumption.”

In terms of our clients’ investments both the Tactical Allocation Portfolio (TAP) and Sector Equities (SEC EQ) models opened the quarter in a risk-off allocation following the selloff that began in February. A result of the Trump administration’s global trade war. Quickly adding risk as conditions become more favorable following Liberation Day on April 2nd and the subsequent 90 day stay on reciprocal tariffs shortly after. Both models are positive on the year with the more concentrated TAP model faring better both Quarter and Year to Date. We remain committed to an active approach and find historically it can take time following a risk-management event of this nature. As of this writing, all equity and fixed-income models are fully invested. Our longer-term numbers remain strong and consistently above targets we set in your financial plan. A comfortable retirement is of course our collective goal. We look forward to hearing from you soon.