Renewed leadership in the Information Technology sector following a volatile Q2 drove equities higher again in Q3. Fueled by an unwavering appetite for AI driven investment in infrastructure. More on that below.

Investors moved past their fear of President Donald Trump’s tariff policy, the harshest of which were for the most part abandoned. And despite the ‘V shaped’ bear market cycle in Q2 the broader economy on the surface remained healthy.

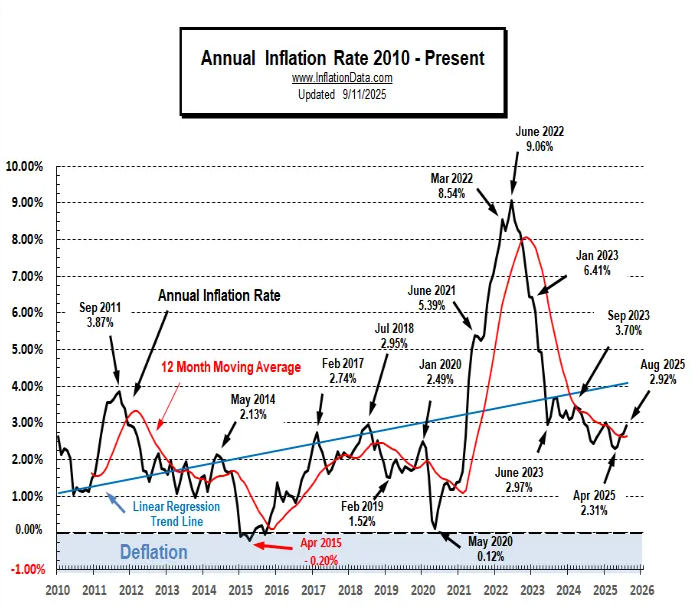

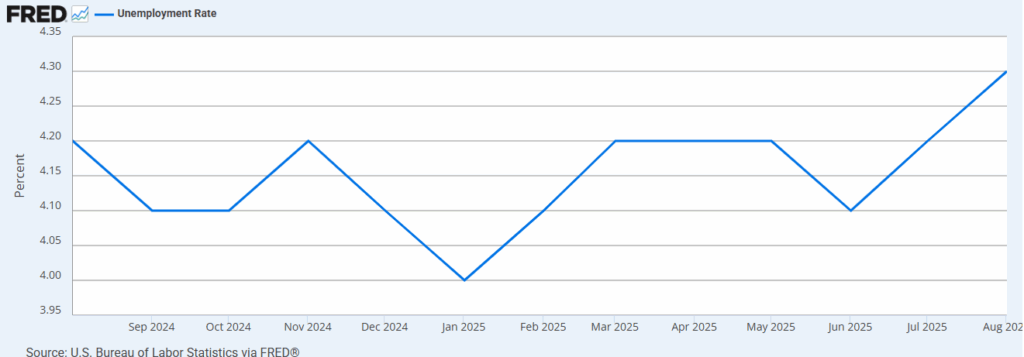

Only to show cracks over the course of Q3. Downward revisions to jobs growth were the catalyst, rising unemployment contributed, debate as to an independent Federal Reserve, and ultimately higher readings of inflation led to an unclear picture for investors. All leading to the Fed cutting interest rates for the first time since late 2024 in an effort stimulate growth and reduce unemployment. Fed Chair Powell’s concern shifted squarely from inflation to the labor market.

Aside from the broader economy we wanted to touch on what many are referring to as the AI bubble or AI faceplant. Essentially unprecedented capital being invested into physical infrastructure that mega-cap technology companies have yet to monetize. Drawing comparison to the dot-com bubble of the late 1990s and early 2000s. We are not here to forecast the growth or profitability of a handful of companies yet certainly cause for concern. The ‘new economy’ Nasdaq index experienced a 77% fall from its peak between 2000-2002 after all. We have mentioned it before that Apple, Microsoft, NVIDIA, Alphabet, Amazon, Meta Platforms and Tesla currently make up ~36% of the S&P 500 Index’ capitalization and in 2024 represented 55% of the index’ annual return. Whether this is sustainable long-term is up for debate. 1st & Main prides itself on risk-management and rest assured if the bubble does burst, we have a close eye on your bottom line.

We would note our investors hold each one of these companies in the broad market, Exchange Traded Fund (ETF) portion of both the Tactical Allocation Portfolio (TAP) and Sector Equities (SEC EQ) models via SPY, QQQ and MGK. And from time to time have owned the individual equities outright. Yet our prudent, diversified approach does not currently allow either model to allocate Information Technology at 36% of a broader model. Both equity models’ intermediate to long-term results remain sound as we continue to work through the recent phenomenon that is AI driven tech. Our goal of course is to transition every household we work with from its respective growth and earnings years to comfortably retired.

In terms of fixed-income, bond markets began pricing in Fed interest rate cuts as early as June of this year. Driving yields down from a near-term high of 4.30% to 3.85%. Making short-term US Treasuries less attractive. As model level US Treasuries come to maturity we will reevaluate, though have already shifted some of our investors fixed-income exposure to trusted managers at Guggenheim Investments and First Trust Portfolios.

We appreciate you taking the time to read this quarter’s newsletter and are here to help at every step along the way.