There were several major themes in the broader economic universe last year, several of which were amplified in Q4. All of which have been covered in previous Newsletters.

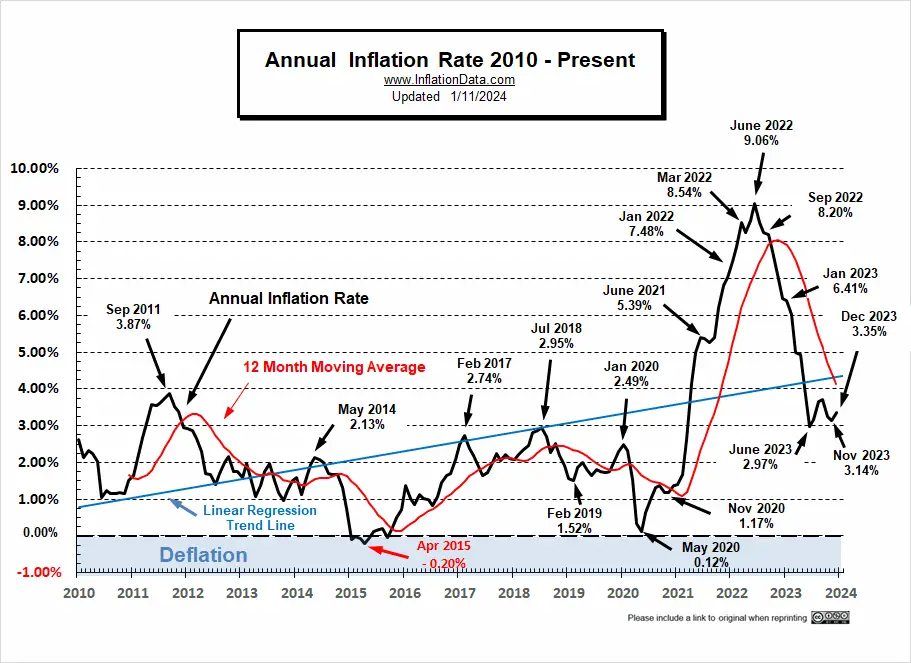

It goes without saying interest rate sensitivity influenced markets in a measurable way. The shift to a dovish monetary policy stance from the Fed fueled equity returns in Q4 as fears of recession turned to ‘higher for longer’ sentiment. Fed chair Jerome Powell forecast several interest rate cuts in 2024 at the December meeting of the Federal Reserve Board of Governors. The first projected to come as early as March. A move that now seems unlikely as the Consumer Price Index (CPI) ticked higher in December leading us to believe rate cuts are now more likely in the second half of this year.

It is remarkable what the Fed has done to tame inflation from its over 9% peak in June of 2022 to just over 3% at the end of last year. All while keeping the domestic economy from slipping into recession, harnessing the so called ‘soft landing’ scenario. You’ll note at the end of Q3 we felt recession was likely in the fist half of 2024, proving how quickly monetary policy and outlook can change.

Link courteosy of: https://bit.ly/3RJ5tu1

As mentioned in our Weekly Market update last week there are a number of factors propping up the economy. In addition to nearing the Fed’s 2% target rate of inflation, which in our opinion is years out into the future and should potentially be revised, Gross Domestic Product (GDP) rose at an annualize rate of 4.9% in Q3. And while not expected to be in that same neighborhood, Q4 should remain historically average in the 2-2.5% range. While global growth is indeed slowing, our economy remains in moderate expansion mode. In large part due to a robust labor market. As we’ve stated in the past consumerism accounts for roughly 70% of GDP. Not only is unemployment at a historic low, but labor market participation rose over the course of 2023. Furthermore, wage growth is now exceeding inflation leaving workers with disposable income. All of the above bodes well for avoiding recession and for continued growth looking forward.

One potential headwind being deflation, which is currently affecting the price of goods but not necessarily service sectors of the economy. Deflation is certainly something the Fed is monitoring and undoubtedly a factor in potential rate cuts to boost the economy and to restore stability in 2024. We also find ourselves in a very unique election year. One with unpopular presidential candidates representing both parties. It is far too early to project longer term outcomes. We are certain to report back on how financial markets react later in the year.

We have covered the concentration of mega-cap returns within the S&P 500 index over the course of the year and will not revisit in much detail here. Other than the Tactical Allocation model (TAP) and the Sector Equities model (SEC EQ) have, or currently own, several of the seven technology names that make up what equates to approximately 30% of the market cap weighted index. If you include Exchange Traded Funds (ETF) model allocations we have owned them all.

The above, however, did not equate to meaningful returns in the models comparable to those for the S&P 500 index in 2023. Both models lagged as we made several attempts over the course of the year to harness positive trends, only to see strong, quality companies and model selected ETFs fail to gain traction. A difficult environment comprised of five measurable pullbacks led the way just slightly higher. Fixed-income had a positive impact for our more balanced investors. We will maintain our approach using US Treasury Bonds in this space at least through May maturities this year. We’ll then be forced to reevaluate if rates do indeed come down. The 5% plus yields we’ve enjoyed will almost certainly follow suit in a falling rate environment making the treasury market less attractive. Whether we build fixed-income models internally or outsource to the fund managers we’ve had success with in the past remains to be seen. We will of course report back as future fixed-income allocations take shape.

As you know our equity and fixed-income models are constructed to identify and follow trends within the market using a series of technical indicators coupled with non-wavering risk-management measures. We are optimistic the road in 2024 will be less bumpy. We remain close to fully allocated with moderate allocations to cash and cash equivalents, always keeping an eye on risk. Those who have been with us long-term recognize that occasionally the models lag, but more often keep pace with our beat their benchmarks. Over longer periods of time we remain confident 2023 will have little if any impact on achieving your goals. And are always available to revisit just that.

We thank you for your trust and look forward to a new year.