What a year 2025 turned out to be. On April 2, 2025, President Donald Trump announced historically large tariffs on all US imports. China quickly retaliated with a 34% tariff on all American imports; Europe then joined the fray as did most countries representing a meaningful trade partner with the US. By the close of trade of April 4, the Dow Jones had lost over 9%, with the S&P 500 entering a bear market and losing 10%, and the Nasdaq Composite entering a bear market and losing 11%. At the lowest point on the following Monday, April 7, the S&P 500 was down 23% from its recent all-time high in February 2025. As trade policy became far less aggressive, China specifically negotiated better deals agreeing to stem the flow of fentanyl to the US, equity markets turned back to growth opportunities primarily driven by the Information Technology and Communications Sectors leading to double digit returns by year end.

We have written extensively about technology and artificial intelligence’s oversized allocations to the capitalization weighted S&P 500 index in our Weekly Updates and Quarterly Newsletters so won’t rehash it here. A phenomenon that guided us to construct a ‘new’ capitalization weighted approach related to how we manage equities in our clients’ accounts. One that more closely mirrors the allocation of the index. And one we are beginning to roll out in the new year. We encourage our investors to discuss with their specific advisor as to the suitability of this approach within your accounts.

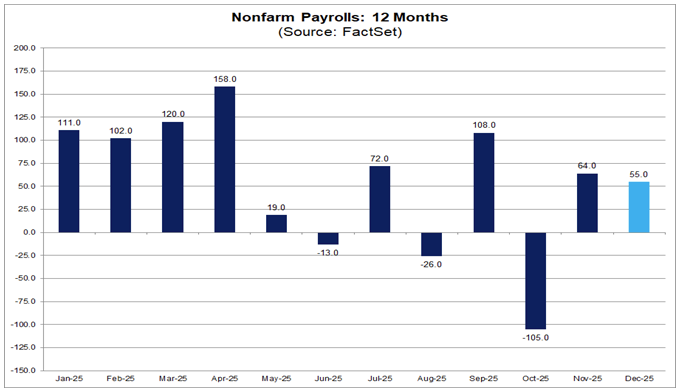

From a macro perspective monetary policy shifted from inflationary fears to the labor market. The unemployment rate reaching 4.6% in November. As a result, The FMOC ultimately cut the benchmark Fed Funds rate three times, once in September, and again in October and December. Bringing the target to 3.50-3.75%. It is worth noting that the Fed Funds rate influences a wide range of borrowing costs from mortgages and car loans to the strength of the dollar. Though it is in fact the rate banks charge each other overnight and thus fundamentally short-term in nature. Many fear additional cuts will not have a measurable impact on longer-term rates more directly influenced by the bond market. And perhaps no meaningful impact on future affordability. A buzz word that gained momentum across party lines leading up to and following the November off-year election cycle.

We are looking forward to what 2026 has in store. Rest assured our primary focus remains squarely on risk management. The drive to create a capitalization weighted approach added enhanced risk controls across all models, and also indicators that will allow us to embrace opportunities earlier than has been the case in the past. In short, very exciting times at 1st & Main and we look forward to sharing with you.

It goes without saying as the Fed Funds rate dropped, so did the yield associated with the primarily short-term fixed-income securities we owned over the course of the year. Both in US Treasuries and the fund managers we outsource a portion of the fixed-income model to on your behalf. Currently hovering in the 3.5% range. For our more moderate and conservative investors this remains in our comfort zone.

Once again we cannot thank you enough for naming us the Best of the Vail Valley’s Financial Planning company for 2025-26. We are honored for the second year in a row! We look forward to hearing from you soon, as always, we’ll be reaching out to you periodically as well. Happy new year, dream big, we are here to help in every way possible!