Equities around the world continued their sell-off over the course of Q2 entering bear market territory for the second time since the financial crises of 2008-09. What exactly causes bear markets is unique to the economic conditions that accompany one, but in its simplest form is when a given index, the S&P 500 in most cases and the benchmark we most often use at 1st & Main, measures a drop from its most recent high in excess of 20%. However unsettling they may be history tells us that markets tend to recover and more often than not offer higher returns for investors who endure them during the recovery phase.

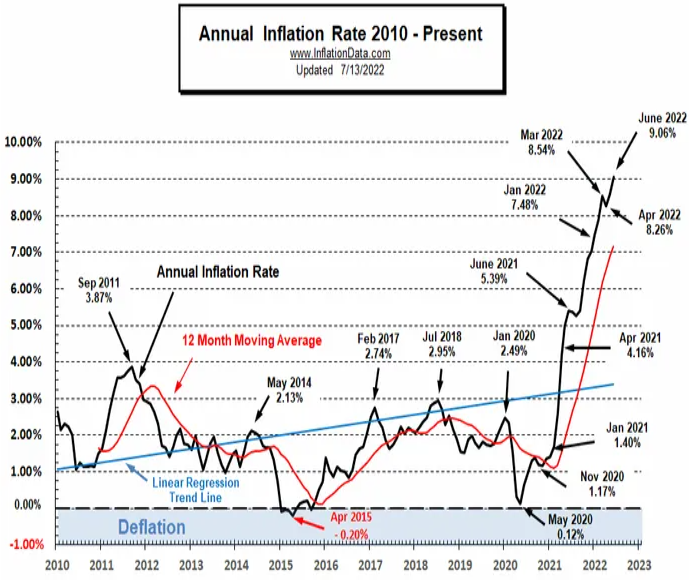

In this case it goes without saying economic conditions through June remain squarely focused on inflation. The most recent reading of 9.1% being the highest since November of 1981. An even higher figure than we reported in this newsletter just 3 months ago (7.9%).

Image courtesy: https://bit.ly/3RJ5tu1

Couple spiraling inflation with ongoing geopolitical risk (Russia/Ukraine and COVID-19 in China), sticker shock at the gas pump and generally speaking across the entire commodities sector (despite recent reprieve). Add higher borrowing costs for both consumers and businesses and Q2 presented a perfect cocktail for slowing economic conditions and double-digit losses for equities.

It goes without saying riskier assets led markets lower. Growth-oriented equities in the technology and consumer discretionary sectors in particular. Equally as important, as the Federal Reserve has begun to aggressively tighten monetary policy, was the ripple effect across fixed-income markets. Due to the inverse relationship between interest rates and bond prices fixed-income has become less of a safe-haven for investors looking to move out of harms way posting almost double-digit losses year-to-date as measured by the S&P U.S. Aggregate Bond index.

The one silver lining we see at 1st & Main, and the only meaningful statistic to potentially stave off recession, is a continued historically strong labor market. Employment rose by 372,000 jobs in June leaving the unemployment rate at 3.6% for the fourth consecutive month. As intriguing is the labor force participation rate of 62.2%. Not quite at pre-pandemic levels but a sign that those who want to work are able to find employment. Likewise, wages rose 5.2% year over year in May, albeit offering a counter-argument that wage growth is being outpaced by inflation in a measurable way. We’ve spoken about GDP in the past and feel as though as long as consumers are employed and continue spending we could avoid a second consecutive quarter of economic contraction or in the event of recession perhaps mild.

It goes without saying we typically don’t get as bogged down with data points in this newsletter as we have above. But felt it worth noting where we measured potential strengths and certain weaknesses over the course of Q2.

As a result of what we’ve outlined Q2 was one of the more trade heavy quarters on record. Our equity models tested certain sectors and companies that were showing signs of life and not a lot stuck. All while maintaining a well above average allocation to cash on the equity side. And a revamped approach to fixed-income investing strictly in U.S. 3-month treasury bills to limit interest rate risk. In short, we spent the quarter in full-blown risk-management mode and don’t foresee a change to that strategy until we see measures of inflation come even mildly under control. The strategy which allowed us to limit losses to less than half of that of the S&P 500 index on the equity side and just a fraction of the S&P U.S. Aggregate Bond index on the fixed-income side seems to be here to stay.

We understand current economic conditions can be unsettling and that we as investors will start to question what lies ahead and its impact on our futures. Given the models’ performance and aversion to risk we feel strongly it should have little to no effect on you and your family’s long-term success. Nor an immediate impact to your bottom line should downside exposure increase. We are always available to review, take stock and alter as needed. And look forward to hearing from you soon.

Fraser, Dudley, Alex, Josh, Christie & Melanie